The No Surprises Act was enacted by a bipartisan majority in Congress, signed by President Trump, and implemented by President Biden. The patient protections began on January 1, 2022, and since then American patients are celebrating that surprise bills are finally in the rear-view.

As Katie Keith notes in a recent interview with American Benefits Podcast, the law was passed because of the impact out-of-network surprise bills have had on patients. She said, “1 in 5 patients have received this kind of surprise out-of-network bill in an in-patient setting. 1 in 6 have received a surprise out-of-network bill for emergency care. […] These are four sometimes five, six figures that patients are asked to pay when they are in this classic situation where you literally have no choice about the provider you are going to see.”

Sadly, the statistics Keith notes are the product of very real and devastating experiences patients have had. We urge the Biden Administration to stay the course on ensuring patients are protected – and that egregious lawsuits to end or weaken the patient protections are stopped in their tracks.

- WBTV: Patient stuck with $28,000 hospital charge searching for billing errors and inflated costs to drive price down.

“When Daryl Procunier sought emergency care in early 2021, he visited a local hospital, only to find that the care he received came from an out-of-network provider. After leaving the emergency room, he was handed a bill totaling thousands of dollars that he was expected to pay. When he was given the total, “They said $45,000 originally. It was kind of life a phone drop moment.” Procunier never would have sought care at the facility had he known he would receive a bill of this magnitude.”

Watch Daryl’s story here.

- New York Magazine: The Air-Ambulance Vultures A search for why my flight cost $86,184 led to a hidden culprit: private equity.

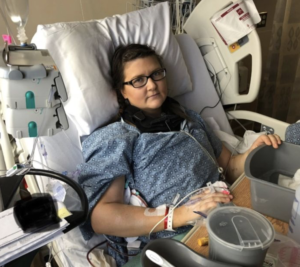

“Kathleen Hoechlin was in the intensive-care unit, wondering if she would ever walk again, when she and her husband, Matt, started receiving the phone calls. It was January 2018, and the couple had just gone skiing in Mammoth Lakes, California. On the last run of the day, Kathleen skied over a small jump and landed on her back, shattering the L1 vertebra in her lower spine. With the nearest hospital ill equipped to handle the required surgery, she was loaded onto a small plane and flown 300 miles south over the Sierra Nevada mountain range to Loma Linda, where she underwent 12 hours of surgery to replace the vertebra with a metal implant.

“The phone call, which the Hoechlins received less than a day after the surgery, was from the air-ambulance provider, Guardian Flight, informing them that the plane ride had cost $97,269.

“The couple tried not to panic, holding out hope that their insurance policy would cover the cost. But when the explanation of benefits finally arrived, it showed that Guardian Flight was out of network and that their policy would cover only $17,569, leaving the Hoechlins responsible for the remaining $79,700. Guardian Flight continued to hound them, with Kathleen not yet out of the full-body brace she was sent home in. ‘They were calling the week I got home,’ she says. I just told them, ‘How can you sleep at night? I can’t talk to you when you’re asking me for this money while I’m trying to learn to walk again.’

“From then on, Matt dealt with the incessant phone calls himself and managed to negotiate the remaining balance down to $20,000 after telling Guardian Flight that he and Kathleen would have to file for bankruptcy if it were any higher. Between their savings, gifts from family members, and a GoFundMe campaign, the Hoechlins managed to pay off the remainder.

“Hoechlin, who has since gotten certified as a patient advocate to help others navigate their insurance battles in her free time. ‘And I’m so grateful for the crew and everything. They deserve to be paid — but a fair amount.’”

Read more about Kathleen’s story here.

For these patients, and thousands more across the United States, the No Surprises Act will now protect them from the high costs of out-of-network care. To ensure that we don’t revert back to the old days of surprise bills, it is essential that the No Surprises Act is implemented in full to ensure patient needs are put first and that the pocketbooks of out-of-network providers will never come before the financial stability of American families.

###

Recent Comments